Calling All Online Business Owners who are Ready to Maximize Their Income…

Unlock your tax deductions,

streamline your accounting processes,

and skyrocket your income in a mere 2 hours

Without all the complicated accounting jargon

Keep more of your hard-earned money in your business without selling more products or courses

This course will:

Transform your personal expenses into legitimate tax-deductible business expenses, maximizing your deductions and boosting your savings.

Unlock the secrets to effortless tax filing and save hundreds or even thousands of dollars per year with ease and confidence.

Discover the true importance of keeping good records and how it can positively impact your bottom line.

Wave goodbye to tax-related stress and anxiety as you gain the knowledge and tools to navigate the filing process smoothly.

“Even after being in the industry for over 3 decades

I learned something on every module.

Her wisdom and experience was easy to follow

and I loved that I could go back and review things

as they pertain to my situation.”

- M. Kvick

“Linda's insight inside the course gave me the confidence and assurance that I can navigate the financial side

of things in my new business.”

- L. Allen

Do you find yourself…

dreading tax time due to a lack of organization,

constant worry about missed deductions,

uncertainty about your tax liability,

confusion surrounding tax deduction rules?

Imagine...

saving hundreds or even thousands of dollars per year without worries,

stress, and feelings of being overwhelmed?

Purpose of tracking your expenses

Uncover WHY keeping good records is important

Discover how to turn personal expenses into tax deductible business expenses

Reduce stress about filing your taxes

Know What Expenses to Track and

How to Track Them

With a better understanding of tax laws, you will know what expenses you can legally deduct

Know what records to keep so you don't need to be afraid of an audit

Link your bank account to software to save time on data entry

Reconcile a bank account to know you are reporting all your expenses

Have Confidence in

Your Tax Deductions

Feel confident you are maximizing your income by taking all allowable tax deductions

Reduce stress for tax time because you are already prepared

Submit the right paperwork to your tax preparer to save the most money

Share your new learned skills with confidence

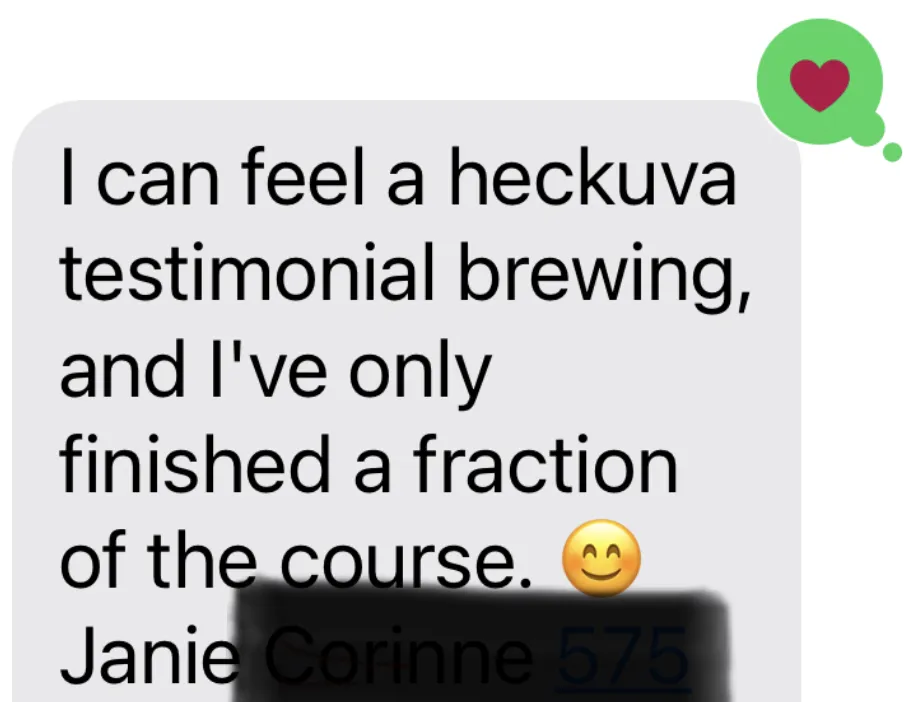

Sounds too good to be true? This is what my clients are saying…

"It's no secret that the tax advantages

of direct sales is one of the best things about

the industry. I decided to purchase Linda's tax workshop because I know that if I stay up on the taxable deductions it can save my family thousands of dollars annually. Even after being in the industry for over 3 decades I learned something on every module. Her wisdom and experience was easy to follow and I loved that

I could go back and review things as they pertain to my situation. We saved a ton this year. In fact, this year with Linda's help we've gotten the largest tax refund that we've ever gotten! EVER!!”

- Marcella K

“Linda's insight inside the course gave me

the confidence and assurance that I can navigate the financial side of things in my new business.

She explains the tax benefits and write offs

in a systematic way to ensure we don't miss advantages we have as business owners.

I learned enough to better communicate with

a bookkeeper and accountant as well.

Prior to taking the course, I was a little bit frozen and not very organized. Now I know the direction I need to start moving in to take control of my business expenses and taxes write offs.

Thank you so much Linda!”

- Laurie A.

My name is Linda Tuttle…

I’ve Made it My Passion to Help Entrepreneurs Run Their Businesses Effectively... so they can enjoy time with those they love and have experiences that create memories.

With over 25 years of experience doing small business bookkeeping and preparing tax returns, 21 years as a licensed CPA, and 10 combined years of experience in network marketing, I have the skillset to help you with the financial side of your business.

Accounting and taxes are a necessary part of running a business, but you don’t need to do it alone.

Let me help you with this part of your business so you can focus your time on what's most important.

Let me give you a SNEAK PEEK...

See what's inside the course and what topics are covered

Here's how it all breaks down...

Here's what you can get inside

the Profit Booster Crash Course

Module 1: Purpose of Tracking Expenses

Why it's important to track your expenses

You are an Independent Contractor

Easiest Way to Track Expenses

Module 2: All Things Tracking Details

What is a Business Expense?

Hobby Loss Rules

What Expenses Are Tax Deductible

Auto Rules

Travel and Meals Rules

Home Office Deductions

Paying Children as Employees

Self-Employed Health Insurance

Module 3: How to Track Your Expenses

QuickBooks Online

Setting up your Online Account

Linking your Bank Account and Importing Transactions

Entering Bank Transactions

Manually Entering Transactions

How to Save Receipts

Reconciling your Bank Account

Module 4: Preparing for Tax Return Preparation

Tax Identification Number

How to Run Reports

Details about Auto Expenses

Business Use of Home Reports

How Numbers will Be Reported on Your Tax Return

Self-employment Tax and Estimated Tax Payments

Profit Booster Guarantee

Watch the videos and go through the training at your own pace in less than 2 hours.

Come away with the tools to maximize your income and feel confident

in your growth plan and ready for tax time.

I feel so certain you will learn something new from this crash course

that if you go through it and don’t feel empowered with new information

to help your business save money this year and for years to come,

I will give you all of your money back.

Original $497

You can get ALL of this and implement it into your business now...

for just $97!

Purpose of tracking expenses

All things tracking details

Confidence in tax deductions for your business

Why tracking expenses in your online business is important

Details on what you should be tracking and tax deductions that are available to you as a business owner

Details on how to set up your QuickBooks account

How to enter transactions and reconcile a bank account

Walkthrough reports to run be ready for filing your tax return

Valuable information to save you thousands in taxes

Again, Here is Everything Included:

25 Self-paced easy to digest lessons

Lifetime access to the course so you can refresh your skills whenever you want

Module 1: Purpose of Tracking Expenses Stay in control of your finances as an Independent Contractor with the easiest and most effective way to track your expenses

Module 2: All Things Tracking Details Demystify business expenses, from hobby loss rules to tax-deductible expenses, auto and travel rules, home office deductions, paying children as employees, and self-employed health insurance

Module 3: How to Track Your Expenses Streamline your expenses with QuickBooks Online: easily set up your account, link your bank, import transactions, enter bank transactions, save receipts, and effortlessly reconcile your bank account

Module 4: Preparing for Tax Return Preparation Master your taxes with ease: understand tax identification numbers, how to run reports, navigate auto expenses, business use of home reports, how numbers are reported on your tax return, and tackle self-employment tax and estimated tax payments

If you’re still reading, don’t worry. I have a 30 day money back guarantee plus you can go through the training at your own pace.

Once you grab the course you will be given access to your course portal and my facebook group where you can ask questions as they come up.

I will teach you the skills to save more in taxes by implementing the information in this course than you will spend on the course itself.

Linda Tuttle

Certified Public Accountant

Adventuringaccountant.com All Rights Reserved @ 2024